|

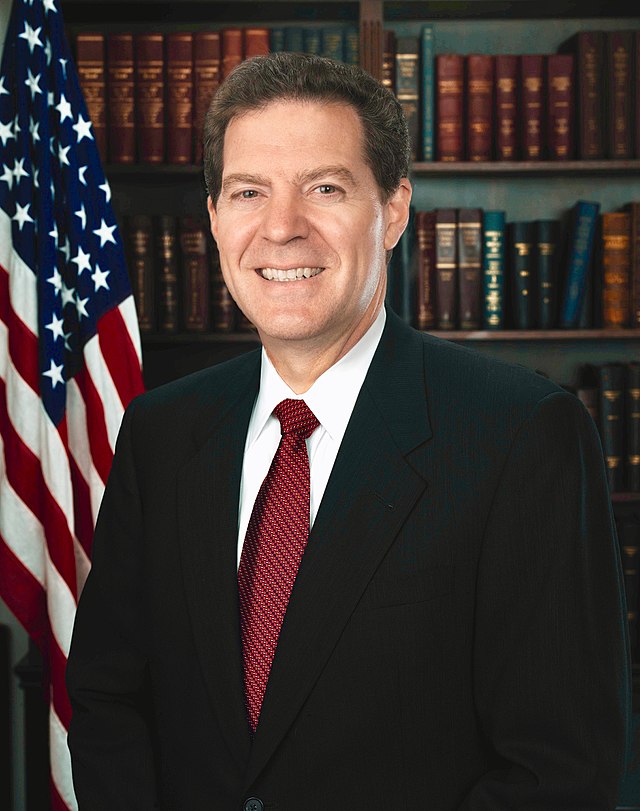

| Kansas Governor Sam Brownback |

Kansas Governor Sam Brownback enacted the broadest tax cuts in Kansas history. He also signed into law comprehensive legislation which defends the life of the unborn, as well as comprehensive reforms in public education, welfare, and healthcare. As one of many governors post 2012 with like-minded legislative supermajorities, the former US Senator and Presidential candidate could experiment with free market reforms long touted by Republicans and conservatives, yet neglected because of Democratic opposition.

After following through on these

campaign promises, Brownback is struggling for reelection. One hundred fellow Republicans have endorsed his

Democratic challenger Paul Davis. He has angered members of his own party

because is reforms cut programs which those Republicans championed or relied

upon. Many of those Republican dissenters lost their seats to Brownback

Conservatives now venting their bitterness. This mounting opposition may amount

to Brownback's defeat from the majority of aggrieved minorities, according to

local reports.

Ignoring the political blowback,

have Brownback's reforms lived up to the claims of conservative policy wonks or

have they failed to deliver on their pretended promises?

Tax fighter Grover Norquist submits that Brownback is under

attack from the Left because his proposals will eliminate numerous tax burdens,

and will work out. Those reforms will phase out incomes taxes on individuals

and businesses as state revenues increase. Brownback's success in November will

encourage other red state governors to pursue similar cost-cutting, limited

government reforms.

|

| Grover Norquist |

Norquist elaborates:

The genius of Brownback’s 2013

legislation to abolish the income tax over time is that the law now states that

each year that state revenue comes in above a two percent increase—and this

happens in a normal period of modest growth—all the additional revenue is used

to permanently reduce the state personal income tax.

Writing for the National Review, Amity Shlaes highlighted the success of

Brownback's reforms:

The governor led the state

legislature in implementing a series of tax cuts that included a staged

reduction in income-tax rates and the repeal of taxes on sole proprietorships.

The state also took little steps to lure or keep business and families. Example:

phasing out mortgage-registration fees. In other words, Brownback put out the welcome mat.

The results:

Bureau of Economic Analysis data show that

non-farm proprietor income, a.k.a. revenue from businesses, including

corporations, LLCs, and sole proprietorships, rose 26 percent from the first

quarter of 2011 to the first quarter of 2014. This rate is higher than those of

neighbors Colorado, Missouri, Oklahoma, and Nebraska, and also higher than the

nation’s average. Unemployment, every politician’s hot topic, is at 4.9 percent

in Kansas, lower than in nearby Missouri, Ohio, and Illinois. According to

state economists, the share of total jobs that are private-sector non-farm jobs

has risen by 17 percent relative to early 2011.

Low unemployment and booming

businesses have met against budget shortfalls, because the projected revenue in

2013 was half of what Brownback had predicted. Compared to her neighbor states,

the Sunflower State is blooming broader and brighter.

|

| Aerial view of Kansas City, Kansas (Which had marked economic improvements over Kansas City, Missouri) |

However, tax and spending cuts do

not create automatic wealth. Despite the budget shortfalls, Shlaes defends

Brownback's reforms in relation to the expiration of the Bush tax cuts for 2013

also pushed Kansas investors to recoup their profits early, while diminishing

the final tally in 2013 and 2014.

Despite conservative defenders,

Brownback’s reforms have many detractors. The New York Times could not

ignore the budget shortfalls.

Guest Columnist Josh Borro starts out with “Kansas has a problem”, yet he did recognize

the Bush Tax cuts, then suggested that the Kansas legislature cut taxes deeper

than anticipated. His criticism leaves out empirical data, rendering his

criticisms less credible. Ironically, the writer points out that as a freelance

writer, he would earn more money because of a tax-free income as a sole

proprietor in Kansas:

The Times has me on its staff, but

it could commission freelance work from me instead. Income from the same work

would then become tax-free under the Kansas rules.

Even in faulting Brownback's tax

rollbacks, Borro admits he could be saving money under those reforms.

Voices for Liberty in Wichita outlined the

success of these policies, as well as the source of the apparent failures:

While tax reform hasn’t produced the

“shot of adrenaline” predicted by Governor Brownback, the problem is one of

political enthusiasm rather than economics. Most elected officials are

prone to effusive optimism for their ideas, just as opponents to their ideas

can often be counted upon to distort and deliberately misstate information in

pursuit of their own beliefs.

Then

Relocating a business is also not

something that happens quickly. For starters, leases might have several

years to run before a move is feasible.

The data are clear in low-tax

states, that business is better, jobs are more plentiful.

What about Kansas? Where’s the

money, so to speak?

Kansas pushed through these tax cuts

at a unique time, as the United States was exiting a deep recession, as the

federal government was raising taxes, and the regulatory state was expanding

under ObamaCare. Besides, based on a number of economic metrics, Brownback’s reforms

are spurring growth, and like all major reforms, time is essential for the

long-term benefits to develop.

Politically, however, time is at

best a limited asset, which Brownback is losing, and with an aggressive,

liberal media keen to pick out faults and declare conservative experiments a

failure, Brownback has his back to the wall, and may lose reelection despite

the innate efficiency (and long-term inerrancy) of his reforms.

|

| Kansas Summer Field |

No comments:

Post a Comment