The State of the Union

Sunday, February 1, 2026

Saturday, January 31, 2026

Together for Redlands: Dangerous, Anti-Family Radicals (by Peter Michael Hall)

TOGETHER FOR REDLANDS are dangerous, anti-family radicals;

and their comments at The January 27th RUSD prove it.

Written by Peter Michael Hall

January 30th 2026

After

a few RUSD Meetings that were calm, peaceful, and ended pretty quickly; the

last meeting was back on the brand that had become all too ubiquitous over the

last year; that of being loud, chaotic, and lasting well into the night. The

group known as TOGETHER FOR REDLANDS has become well known for causing a ruckus

during Redlands City Council and School Board Meetings; over the last year they

made an unfortunate habit of packing the meeting room for school board

meetings, and having members slander, insult, and verbally abuse The School

Board; specifically President Michelle Rendler, Board Clerk Jeanette Wilson,

Board Member Candy Olson; and sometimes Superintendent Juan Cabral.

A

favorite tactic of theirs is to spam The School Board with Agenda Item Cards

for the first public comment section of the meeting; because anybody can fill

out one card for each agenda item and then speak about each agenda item that

the school board is going to vote on; the maximum allowance of speaking time

allowed is three minutes, but depending on the number of speakers, and the

number of agenda item cards, for the sake of brevity, speaking time can and has

been lowered to as much as 45 seconds per person, per agenda item. During the

second half of public comment, you can only fill out one speaker card. TOGETHER

FOR REDLANDS loves to filibuster The School Board by spamming them with so many

agenda item speaker cards that The School Board is forced for the sake of time

to cut every speakers comment time; and then they complain about the school

board restricting the speech of Redlands residents, and making the meetings run

too long, knowing full well that these are the consequences of their

filibustering.

The

January 27th RUSD Meeting was one of the longest, craziest, and poorly mannered

that I’ve ever had the displeasure of attending; TOGETHER FOR REDLANDS members

interrupted The School Board multiple times during their discussion on agenda

items, and though President Rendler admonished them multiple times to be quiet,

she never asked them to leave, or ordered them removed, even though it was her

prerogative, and she should have.

But

even worse than their actions at the school board meeting, are some statements

made by a few of the most well known and influential members of the group. I

was particularly troubled by the comments of Michael Paisner, who in one of his

four agenda item comments accused Board Member Candy Olson of not seeing

children as human beings; and claimed she said children are the property of

their parents; he also seriously championed the idea of letting minors at the

extremely young age of 12 navigate the health care system on their own; and

keep their medical records private from their parents. I strenuously object to

this idea which unfortunately is already codified into California’s State Law;

I object, because who pays for these hypothetical children’s medical bills?

Their parents, or otherwise specified legal guardians, and since they’re the

ones financially responsible for their children’s medical bills, then they have

the right to access their children’s medical records on demand; but Michael

Paisner and other members of the misnamed group TOGETHER FOR REDLANDS would

place a wedge between children and their parents; and separate them entirely if

they can; and all under the guise of providing children with their

Constitutional Rights of Freedom of Speech and Expression, and privacy from

unnecessary intrusion, search, seizure, etc.

Bea

Hamilton, another prominent member of TOGETHER FOR REDLANDS, actually

interrupted Super Intendant Cabral twice at the meeting before this last

meeting and accused him and The School Board of committing HIPAA violations

while they were discussing new board policy 5141.5 regarding mental health care

for students at school; members of TOGETHER FOR REDLANDS have made it bad habit

to complain about unfair treatment at the hands of The School Board; they claim

they’re constantly singled out for punishment because of minor violations, such

as being forced to leave meetings after saying things Board Members don't like.

I have seen unfair treatment towards TOGETHER FOR REDLANDS members by the

school board; but this treatment benefits and rewards them rather disadvantages

and punishes them. Bea Hamilton should have been warned to be quiet or leave

after he twice interrupted Super Intendant Cabral; but nobody seemed to notice

or care, especially the first time, and Super Intendant Cabral only mildly

reacted to the rude interruption the second time.

The

members of TOGETHER FOR REDLANDS need to be put back in their place; they need

to be made aware that the rest of us are tired of their shenanigans, of their

constant need for attention, of their endless emotional manipulation, insults,

and veiled threats of retribution

Thursday, January 29, 2026

Wednesday, January 28, 2026

More Info on Alex Pretti the Antifa Thug of Minneapolis

🚨 BBC obtains footage from January 13 of a man they say is Alex Pretti

— Ryan Saavedra (@RyanSaavedra) January 28, 2026

Videos appears to show him spitting at federal law enforcement and attacking their vehicle

pic.twitter.com/cuXYO6PLIx

GOP: Democrat Senator Walks Back Sanctuary City Stance

Last night, Democrat Senator John Fetterman — who once said it was "xenophobic" to not support sanctuary cities — admits his party’s support of sanctuary cities is dangerous, conceding they do not make people safer and all criminal illegals who are in custody should be turned over.

Democrats have been harboring criminals under the guise of "sanctuary policies" for years — all while boasting about resisting immigration enforcement and vowing another government shutdown over it.

Minneapolis Mayor Jacob Frey says he still refuses to cooperate with immigration enforcement officers, despite proof that the city would be safer if they did.

Immigration enforcement officers should not be continuously demonized for enforcing the laws that Americans overwhelmingly voted for.

Enough is enough.

Sonali Patel

RNC Deputy Rapid Response Director

spatel@gop.com

Monday, January 26, 2026

MassResistance Special Report: Parent Decries the Abuse of the GSA Clubs on Kids

From a mother: What the local school and the LGBT movement did to my son.

There is more to Gay Straight Alliance clubs than you may know.

By Diane Splitz

January 25, 2026

An adult from this LGBT group seduced Diane's son into the homosexual lifestyle. [Photo: CIGSYA]

An adult from this LGBT group seduced Diane's son into the homosexual lifestyle. [Photo: CIGSYA]My son started the Gay Straight Alliance (GSA) club in his high school in 2010. Founded in 1988 by GLSEN (Gay Lesbian Straight Education Network), the national GSA movement had a goal of establishing these clubs and recruiting members in every K-12 school and college across the country. Much of their success can be attributed to the fact that they are part of a well-organized and well-funded network of sexual-radical activists and regional organizations working together to find students like my son and turn them into foot soldiers to uproot our county’s Judeo-Christian foundation, redefine morality, and reshape the culture.

Growing up in a Christian family, I learned that homosexuality was a sin. But I was later taught in college that people are “born that way.” Then in graduate school, I studied the effects of childhood traumas and negative experiences during the formative years on teenagers and adults. The data revealed that sexual abuse, exposure to pornography, being the victim of excessive bullying, and various other factors are the true causes of “sexual orientation” and “gender identity” issues.

So, when my husband and I learned that our son had experiences that made him susceptible to homosexuality and other mental health issues, we were devastated. Our pediatrician referred him to a counselor and over the next few years he seemed to be doing fine.

When we transitioned him from a Christian school to a public high school near our home on Cape Cod in Massachusetts, we didn’t know that the LGBTQ agenda had become so pervasive in the secular schools. Academically rigorous and morality-based curricula had been replaced with ones designed to deconstruct identities grounded in nature, faith, and family while promoting alternative lifestyles – often using graphic content to stimulate impressionable minds. Teachers regularly attend in-service programs where they are trained to insert LGBTQ content into their lessons. Those opposed to these mandates have learned to stay silent or pay the consequences. To put it simply, students are being groomed.

In addition to academic changes, schools now allow Spirit Day, the Day of Silence, Transgender Day of Visibility, pro-LGBTQ assemblies disguised as anti-bullying programs, and other LGBTQ events each year to interrupt what should be productive school days.

Also, students throughout the country participate in the US Centers for Disease Control and Prevention’s Youth Risk Behavior Survey and similar state and local surveys. In these surveys, tweens and teens are asked about their sexual histories and, in doing so, they are introduced to behaviors they often have no knowledge of. The true purpose is to generate curiosity about and normalize such practices. The data is then used to secure public funding to (supposedly) prevent suicide, treat mental and physical issues related to the behaviors being promoted, and to further propagate the LGBTQ agenda.

Given his history and all the LGBTQ promotion, my son approached an activist guidance counselor and said, “I think I might be gay.” Then, without our knowledge, she referred him to the regional Gay Straight Alliance organization, called Cape and Island Gay and Straight Youth Alliance (CIGSYA), now called We Thrive LGBTQ+ and Ally Center for Cape Cod and the Islands.

The names of these organizations have changed in recent years to accommodate students with “identities” previously excluded, such as bisexual, transgendered, and all the newly created identities that people outside of the educational and other woke communities have never heard of.

These centers exist all over the country. For young people, 22-years old and younger, they promise safety, respect, and a judgment-free environment where they will find support, camaraderie, and fun with the chance to go on field trips and attend special events. The larger purpose is far more sinister.

Such centers exist to trap confused adolescents in identities born out of trauma and negative experiences, and to create an army of activists to advance their agenda. While the “born that way” narrative is constantly reiterated, the message to heterosexual allies (who attend to support their “oppressed” friends) is that they are young and don’t really know who they really are. They are then encouraged to experiment.

The CIGSYA headquarters in Hyannis where kids can "become who they really are" without parents' knowledge or interference.

The CIGSYA headquarters in Hyannis where kids can "become who they really are" without parents' knowledge or interference. The sign outside

The sign outsideIn an environment where the level of your victimhood can elevate your popularity – combined with dopamine-inducing sexual experimentation – a non-heterosexual identity can emerge. This is psychological reconditioning occurring behind the backs of parents during the stage of development when hormones are raging and identities are being solidified.

These centers excel at community outreach, developing relationships with activist school personnel in their district. This includes teachers, guidance counselors, and even administrators. These activist educators identify students they can refer to the center to receive counseling, education, and training. New recruits are often assigned mentors – older kids who can guide them and maybe even provide transportation, as our son’s mentor did. They can visit the center and arrive home before their parents return from work, none the wiser.

The kids learn that homosexuality and transgenderism are natural and normal and that they should be their “authentic” selves. They learn about the history and heroes of their marginalized and persecuted group. They are also told that the movement is not about sex but about identity, even while provided with sexually provocative literature, condoms, dental dams, lubricants, and health clinic pamphlets where they can receive free testing and treatment for STDs (without their parents’ knowledge).

Christian kids like our son, get schooled in gay theology. They learn that the Bible affirms homosexuality, that Sodom and Gomorrah were punished for being inhospitable (not sexually immoral) that King David was gay, and that Jesus never addressed homosexuality in the Bible.

What is omitted from their doctrine is the fact that Jesus (a descendent of King David) reaffirmed that God made us male and female, and that sexual relations outside of a marriage between a husband and wife is a sin. As a result, some find their way to progressive churches that will tell them what their itching ears want to hear, while others abandon their faith entirely, conforming to the ways of the culture.

Part of the indoctrination process is learning how to “come out” to people, including parents. Kids are taught how to respond to every possible concern or objection, how to train others in all things LGBTQ, and in cult-like fashion, how to disassociate with anyone they deem too hateful and homophobic to be swayed. While it is commonly believed that parents are the ones who reject and disown their LGBTQ children in family estrangement situations, our experience has taught us that it is more often forced on parents by their children at the encouragement of their new community.

Parents are encouraged to speak with club directors and staff, who are more experienced and persuasive than their children, and are also referred to Parents, Families and Friends of Lesbians and Gays (PFLAG) a nation-wide group made up of pro-LGBT activist parents. They, too, propagandize, indoctrinate, and offer comaraderie.

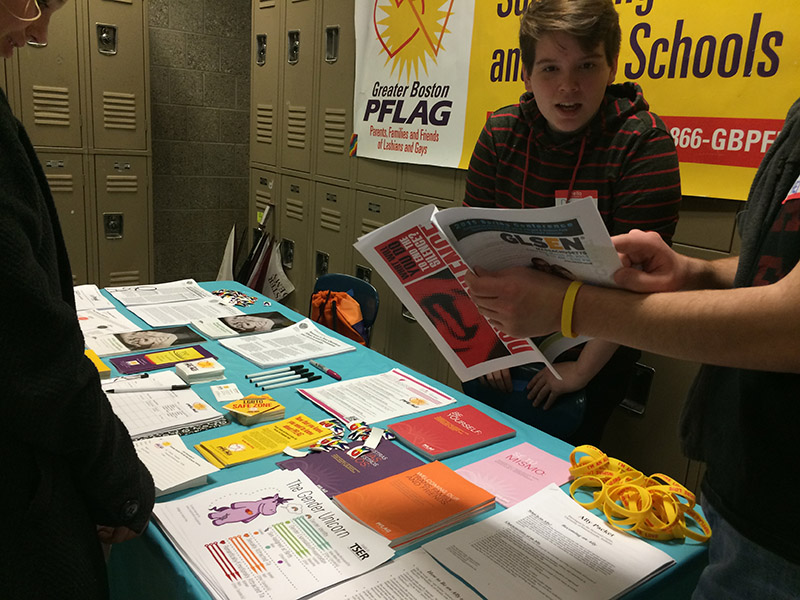

Diane infiltrated a GLSEN regional conference being held at a school. She took this photo of the PFLAG table. Note an adult showing GLSEN LGBT material to a startled young boy. On the PFLAG table are booklets titled "Be Yourself" and "Welcoming our Trans Family and Friends." Next to the booklets is a packet on "Becoming an Ally" to the LGBT movement, the "Gender Unicorn," and other slick LGBT propaganda.

Diane infiltrated a GLSEN regional conference being held at a school. She took this photo of the PFLAG table. Note an adult showing GLSEN LGBT material to a startled young boy. On the PFLAG table are booklets titled "Be Yourself" and "Welcoming our Trans Family and Friends." Next to the booklets is a packet on "Becoming an Ally" to the LGBT movement, the "Gender Unicorn," and other slick LGBT propaganda.The PFLAG activists share stories of the “difficulties” they had when their children “came out” and guide parents toward acceptance. They attempt to scare you into believing your child will commit suicide if you don’t embrace their new identity, and they refuse to hear alternative viewpoints on how such identities may be formed. They won’t discuss concerns over the many illnesses associated with homosexual behavior, such as AIDS and other STDs, hepatitis, sepsis, other infectious diseases, liver cancer, or bowel incontinence (a.k.a. Gay Bowel Syndrome). The ultimate goal is to recruit parents to join in the activism alongside their children.

As a result of activist staff and administrators in our son’s high school working in collusion with the regional GSA center without our knowledge or consent, our son continues to live a homosexual lifestyle. His anger toward us has only increased over time as he has immersed himself deeper into this subculture and he rejects any attempts on our part to reconnect with him. The wounds remain painful to our entire family.

As we maintain hope that he will one day find healing and return home, where he is truly loved, I pray that by sharing our story with other parents we can help to spare other families from experiencing this nightmare.

(See our Special Report: Why LGBT “GSA Clubs” must be banned from all public schools.)

Please help us continue to do our uncompromising work!

Our successes depend on people like you.

Your support will make the difference!